6467 Main Street

Williamsville, New York 14221

Fellow Shareholders,

YouIn some ways 2020 was the year in which the self-storage world caught up with Life Storage’s innovations.

More than any of our peers, we have been bringing digital innovations to storage to enable people and businesses to store their things safely, reliably, inexpensively, conveniently and in ways customized to their priorities.

Thus, in the early days of the pandemic—in April 2020 when global economies were all but shut down—our rentals remained strong—with half of our rentals that month coming through Rent Now, our state-of-the-art digital, contactless platform.

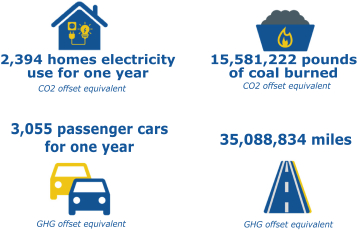

We see growing—and increasingly mobile—global populations needing more—and more kinds of—convenient and affordable storage. Our digital innovations enable us to meet this demand. They also enable us to steadily reduce certain costs—for example, we were able to reduce same-store payroll every quarter for eight straight quarters through September 30, 2020 as our digital capabilities increased—and freed up capital to invest in growth and in future innovations, including our environmental efficiency-related ones.

| *Source: | FactSet; as of March 31, 2021 |

This combined focus on managing efficiently for the present, while steadily building for an evolving future, are cordially invited to attend the 2019 Annual Meeting of Shareholdershallmarks of Life Storage Inc. on Thursday, May 30, 2019 at the Company’s headquarters, 6467 Main Street, Williamsville, New York 14221. The 2019 Annual Meeting will begin promptly at 9:00 a.m. (E.D.T.).

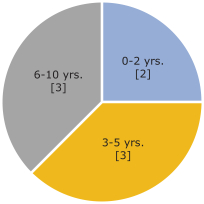

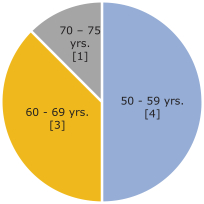

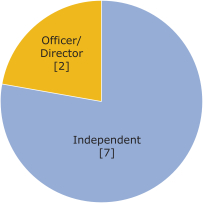

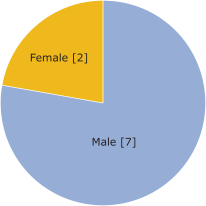

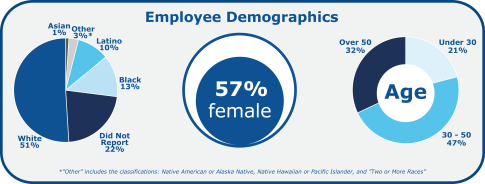

During the past 12 months,since our Company executed on a long planned Board and leadership succession strategy that resultedformation—as illustrated in the appointment of four new directors to the Board and the seamless transition of the Chief Executive Officer role to Joe Saffire, following Dave Rogers retirement after 35 successful years with the Company as one of its original founders. The Board transitions have:

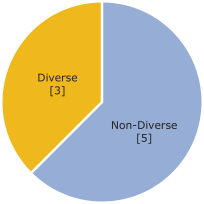

Increased the diversity of our directors;

Expanded the background and skills of our directors;

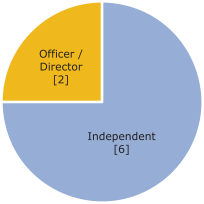

Increased the proportion of independent directors;

Resulted in the election of an independent Chair of the Board; and

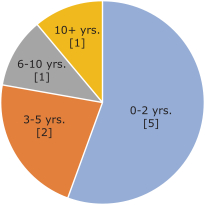

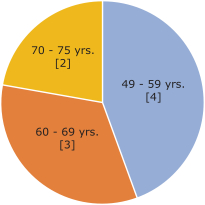

Reduced the average tenure and average age of our directors.

Our Board of Directors is keenly focused on corporate governance, and we are committed to continuing to implement practices consistent withthis long-term value creation.

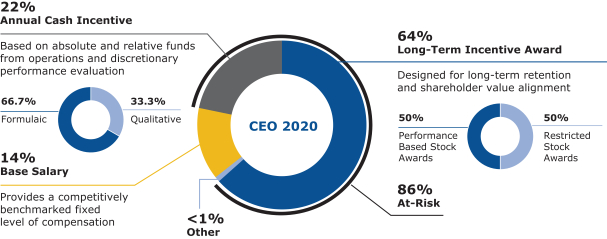

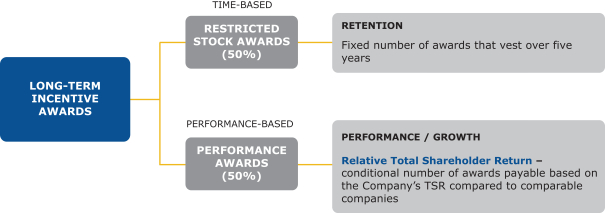

We accomplished a great deal in 2018. The Company performed very well operationally, while also executing on its portfolio optimization strategy to increase exposure to markets with more attractive demographics and to acquire and own newer properties with higher revenue and growth prospects. The team launched an innovative digital rental platform, Rent Now, to meet changing customer behavior, and expanded Warehouse Anywhere, the Company’s differentiated corporate customer value proposition.

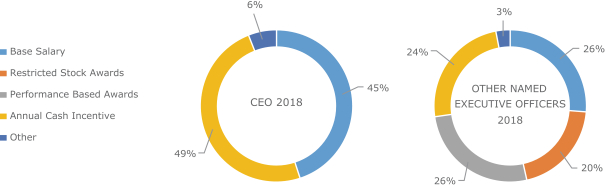

Our performance is reflected in our 2018 total shareholder return chart. We have brought the same discipline and vision to our own board, as our orderly refreshment, including the planned retirement of 9%, which exceededanother one of our founders and our steadily increasing diversity. We plan, in future years, to write to you about how some of our evolving initiatives are bearing fruit and encourage you to read more about what my fellow directors and I worked to address this year in the pages that of the S&P 500 and the US REIT Index.follow.

On behalf of the Life Storage, Inc. management team and Board of Directors, as Chair of the Board, I thankThank you for your continued support investment—and confidence faith—in our team. We look forward to communicating more about our Company’s successes, how our management team will continue to achieve great results going forward, and how our performance impacts our governance and compensation considerations.us.

Sincerely,

Mark G. Barberio

Non-Executive Chair of the Board

April 16, 2019•, 2021